Monetary Donations

In addition to donations of clothing and supplies, Spreading Threads Clothing Bank graciously accepts monetary donations as well to help cover the needs of our foster children, kinship families, and adoptive families. You can feel good knowing your donations go directly to assist local children in Tucson and Southern Arizona in need and that you can make a difference in the life of a child.

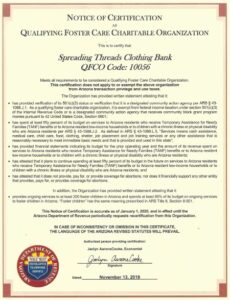

Spreading Threads is an Arizona-based 501(c)(3) nonprofit organization as well as a Qualifying Foster Care Charitable Organization (QFCO). This means you can increase your charitable tax donation for a dollar-for-dollar reduction of your Arizona State Tax liability. As of 2023, individuals may donate up to $526 each year while married couples filing jointly may donate up to $1,051 as Spreading Threads Clothing Bank is a Qualifying Foster Care Organization in Arizona If you donate between January 1 and April 15, 2023, you can donate at these rates and count the donations toward your 2022 Arizona state tax liability.

The Arizona Foster Care Charitable Tax Credit is separate from other tax credits. What this means is you can donate both ways to Spreading Threads to further reduce your state tax liability. The federal tax ID number for Spreading Threads Clothing Bank is 83-1151614 and our State of Arizona QFCO code is 10056.

There are several ways you can donate money to Spreading Threads Clothing Bank. You can donate online or mail a check. All monetary donations are eligible for Arizona tax credit donating to Spreading Threads Clothing Bank, we must receive your online contribution by midnight, April 15 (Tax Day) of the following tax year. If donating by U.S. mail, contributions must be postmarked by April 15 (Tax Day) and be sent to our mailing address.

Arizona Tax Credits

The Arizona Foster Care Charitable Tax Credit is separate from the Qualifying Tax Credit as well as the Private School Tuition Tax Credit, Public School Tax Credit, and the Military Family Relief Fund Tax Credit. You can utilize all five tax credits concurrently to reduce your state tax liability.

To claim this tax credit by donating to Spreading Threads Clothing Bank, we must receive your online contribution by midnight, April 15 (Tax Day) of the following tax year. If donating by U.S. mail, contributions must be postmarked by April 15 (Tax Day) and be sent to the address above.

Contributions to Qualifying Foster Care Charitable Organizations (QFCOs)

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and the second for donations to Qualifying Foster Care Charitable Organizations (QFCO), such as Spreading Threads Clothing Bank. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns.

Effective in 2016, credit eligible contributions made on or before the 15th day of the fourth month following the close of the taxable year (April 15- Tax Day) may be applied to either the current or the preceding taxable year and are considered to have been made on the last day of that taxable year.

Effective in 2018, the Arizona Department of Revenue has assigned a five digit code number to identify each QFCO for Arizona Tax credit purposes on Form 321 and Form 352 respectively, which are included with the Arizona income tax return. Taxpayers must use the “QFCO Code” of certified organizations to claim the tax credits for contributions for QFCOs. The department’s lists of qualifying charities include the code assigned to each organization. The QFCO code for Spreading Threads Clothing Bank in the State of Arizona is 10056.

For more information about Arizona Tax Credits, click here, or consult with your tax professional to learn more.

What’s changed recently?

- Under revised federal tax regulations you may not claim a federal charitable deduction for donations that receive a state tax credit.

- To claim the state credits, a new code assigned by the AZ DOR must be provided to identify each qualified charity uniquely.

- Donations between Jan 1 and Apr 15 may be claimed on either the current or prior-year tax return.

- Starting in 2023, three credits are increased by inflation adjustments annually.

Learn more at the Arizona Department of Revenue

| 2022 Limits | Married Filing Joint | All Others |

Due Date |

|---|---|---|---|

| Qualif Charitable Org | $800 | $400 | 4/15/23 |

| Qualif Foster Care Org | $1,000 | $500 | 4/15/23 |

| Public/Charter School | $400 | $200 | 4/15/23 |

| Private School TSO | $2,483 | $1,243 | 4/15/23 |

| 2022 TOTAL | $4,683 | $2,343 | 4/15/23 |

| 2023 Limits | Married Filing Joint | All Others |

Due Date |

|---|---|---|---|

| Qualif Charitable Org | $841 | $421 | 4/15/24 |

| Qualif Foster Care Org | $1,051 | $526 | 4/15/24 |

| Public/Charter School | $400 | $200 | 4/15/24 |

| Private School TSO | $2,609 | $1,307 | 4/15/24 |

| 2023 TOTAL | $4,901 | $1,307 | 4/15/24 |