Helping Foster Dignity in Southern Arizona’s Foster Children

A grassroots, nonprofit community clothing bank based in Tucson, Arizona, Spreading Threads Clothing Bank provides free clothing to youth in foster care in Pima County and Southern Arizona. Since 2018, Spreading Threads Clothing Bank has offered child-focused clothing services for foster children, foster families, kinship caregivers, and adoptive families. Our mission is to provide a welcoming, comforting, and relaxed setting for Southern Arizona’s foster children and families to find the clothing they need to restore their dignity and self-esteem free of charge.

Foster children and their caregivers can visit Spreading Threads Clothing Bank to “shop” for new clothes for school, church, special events, and daily use. Spreading Threads Clothing Bank also provides clothing for emergency pulls for foster children who are removed from their homes with nothing but the clothes on their backs at any time, day or night. Foster children and foster families are never charged for the clothing and can simply take what they need as they need it.

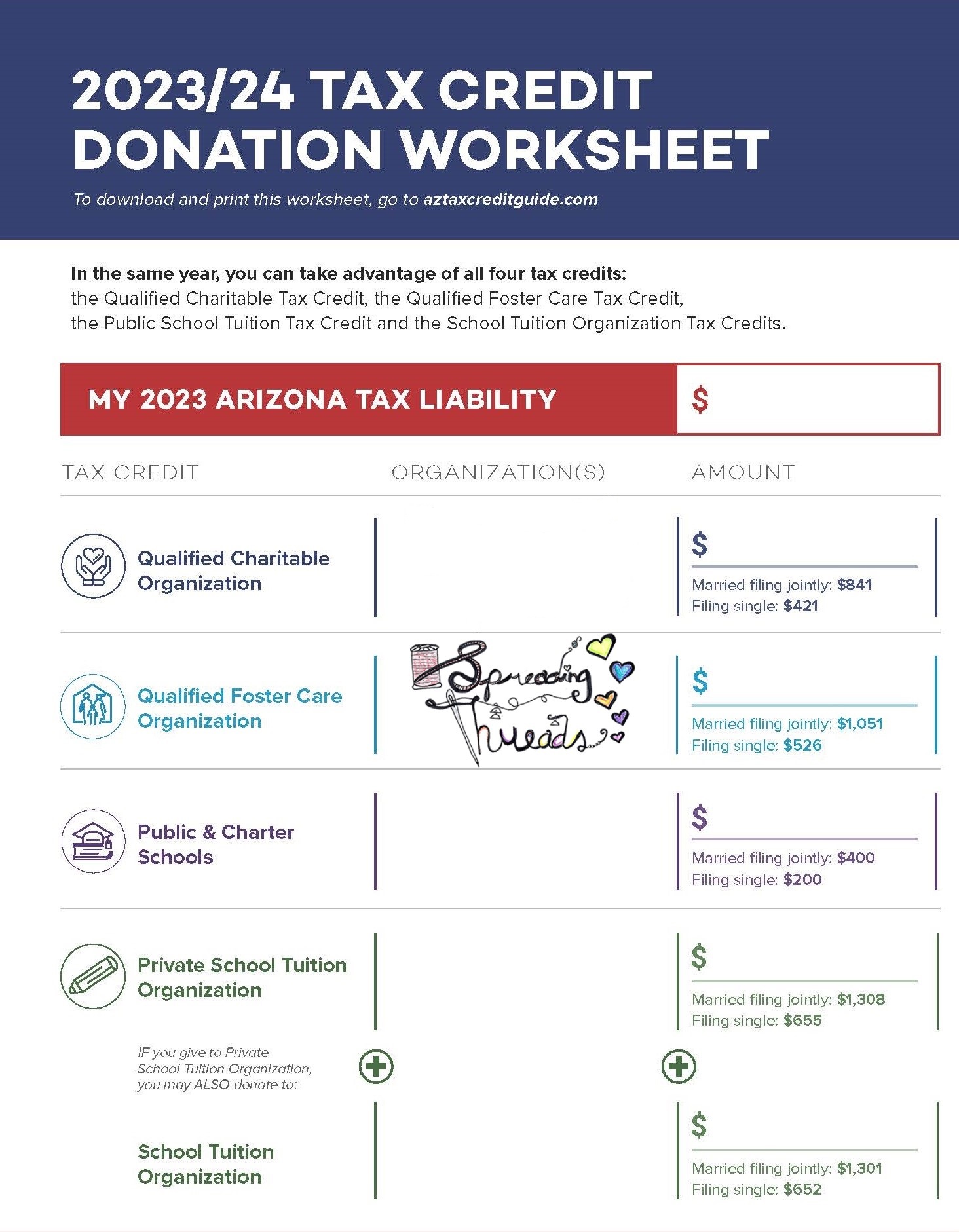

Tax Credit Guides

Below, you will find two tax credit guides to assist you in determining how you can make the most out of your tax-deductible giving in order to reduce your Arizona state tax liability.

The first guide is the 2023/24 Tax Credit Donation Worksheet. This worksheet shows you how you may make tax-deductible donations in four different ways each year to reduce your Arizona state tax liability. As you will see on the chart, Spreading Threads Clothing Bank is a Qualified Foster Care Organization (QFCO) in Arizona.

The other tax credit guide is the Maximizing the Tax Credit Opportunities by Giving to All Four Categories sheet. It shows you how much money you may give as an individual or married couple per year in each charitable category to maximize your tax-deductible donations. For QFCOs such as Spreading Threads Clothing Bank, individuals may give up to $526 and married couples may give up to $1,051 per year.

Arizona Tax Credits

The Arizona Foster Care Charitable Tax Credit is separate from the Qualifying Tax Credit as well as the Private School Tuition Tax Credit, Public School Tax Credit, and the Military Family Relief Fund Tax Credit. You can utilize all five tax credits concurrently to reduce your state tax liability.

To claim this tax credit by donating to Spreading Threads Clothing Bank, we must receive your online contribution by midnight, April 15 (Tax Day) of the following tax year. If donating by U.S. mail, contributions must be postmarked by April 15 (Tax Day) and be sent to the address above.

Contributions to Qualifying Foster Care Charitable Organizations (QFCOs)

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and the second for donations to Qualifying Foster Care Charitable Organizations (QFCO), such as Spreading Threads Clothing Bank. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns.

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and the second for donations to Qualifying Foster Care Charitable Organizations (QFCO), such as Spreading Threads Clothing Bank. Individuals making cash donations made to these charities may claim these tax credits on their Arizona Personal Income Tax returns.

Effective in 2016, credit eligible contributions made on or before the 15th day of the fourth month following the close of the taxable year (April 15- Tax Day) may be applied to either the current or the preceding taxable year and are considered to have been made on the last day of that taxable year.

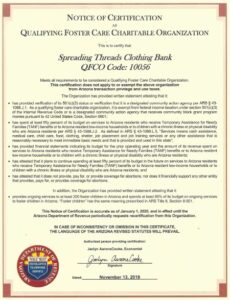

Effective in 2018, the Arizona Department of Revenue has assigned a five digit code number to identify each QCO and QFCO for Arizona Tax credit purposes on Form 321 and Form 352 respectively, which are included with the Arizona income tax return. Taxpayers must use the “QCO Code” or “QFCO Code” of certified organizations to claim the tax credits for contributions for QCOs or QFCOs. The department’s lists of qualifying charities include the code assigned to each organization. The QFCO code for Spreading Threads Clothing Bank in the State of Arizona is 10056.

Monetary Donations

In addition to donations of clothing and supplies, Spreading Threads Clothing Bank graciously accepts monetary donations as well to help cover the needs of our foster children, kinship families, and adoptive families. You can feel good knowing your donations directly assist local children in Tucson and Southern Arizona in need and that you made a difference in the life of a child.

Spreading Threads is an Arizona-based 501(c)(3) nonprofit organization as well as a Qualifying Foster Care Charitable Organization (QFCO). This means you can increase your charitable tax donation for a dollar-for-dollar reduction of your Arizona State Tax liability. Individuals may donate up to $526 each year while married couples filing jointly may donate up to $1,051.

The Arizona Foster Care Charitable Tax Credit is separate from other tax credits. What this means is you can donate both ways to Spreading Threads to further reduce your state tax liability. The federal tax ID number for Spreading Threads Clothing Bank is 83-1151614 and our State of Arizona QFCO code is 10056.

There are several ways you can donate money to Spreading Threads Clothing Bank. You can donate online or mail a check. All monetary donations are eligible for Arizona tax credit.

These tax credit guides are a great starting point for determining how much you may donate to qualify for a dollar-for-dollar reduction of your Arizona state tax liability. For more information about Arizona Tax Credits, click here, or consult with your tax professional to learn more.

What’s changed recently?

- Under revised federal tax regulations you may not claim a federal charitable deduction for donations that receive a state tax credit.

- To claim the state credits, a new code assigned by the AZ DOR must be provided to identify each qualified charity uniquely.

- Donations between Jan 1 and Apr 15 may be claimed on either the current or prior-year tax return.

- Starting in 2023, three credits are increased by inflation adjustments annually.

Learn more at the Arizona Department of Revenue

| 2022 Limits | Married Filing Joint | All Others |

Due Date |

|---|---|---|---|

| Qualif Charitable Org | $800 | $400 | 4/15/23 |

| Qualif Foster Care Org | $1,000 | $500 | 4/15/23 |

| Public/Charter School | $400 | $200 | 4/15/23 |

| Private School TSO | $2,483 | $1,243 | 4/15/23 |

| 2022 TOTAL | $4,683 | $2,343 | 4/15/23 |

| 2023 Limits | Married Filing Joint | All Others |

Due Date |

|---|---|---|---|

| Qualif Charitable Org | $841 | $421 | 4/15/24 |

| Qualif Foster Care Org | $1,051 | $526 | 4/15/24 |

| Public/Charter School | $400 | $200 | 4/15/24 |

| Private School TSO | $2,609 | $1,307 | 4/15/24 |

| 2023 TOTAL | $4,901 | $1,307 | 4/15/24 |